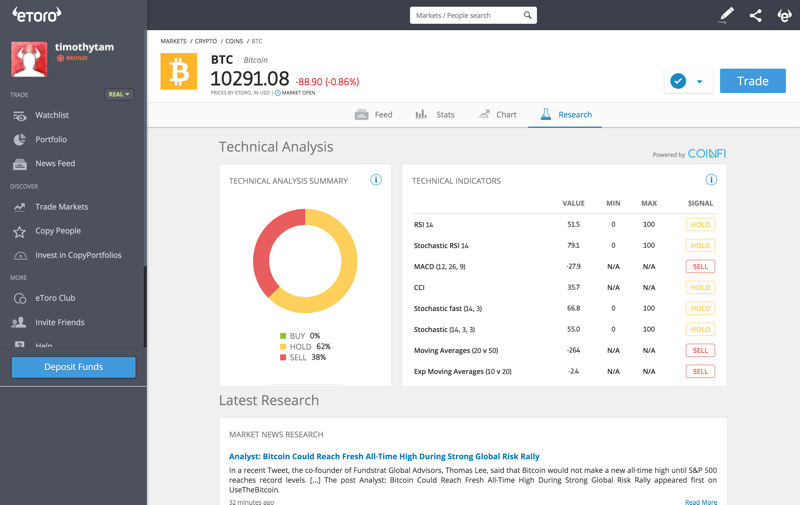

CoinFi Partners With eToro To Provide Crypto Research And Data

HONG KONG - Sep 17, 2019 - CoinFi, the leading market intelligence platform offering Wall Street-caliber trading tools, today announced a partnership with eToro, the multi-asset trading and investment platform, as a crypto assets research and data provider. The integration provides eToro traders and investors with access to a new CoinFi-powered research tab featuring real-time news, analysis, and technical market indicators. eToro acquired a significant stake in the CoinFi token (COFI) as part of the deal.

CoinFi’s research, news, and analysis will be available for all 16 crypto coins on the eToro platform. Product teams at both companies worked closely to seamlessly integrate data streams.

“In today’s volatile crypto markets, traders need up-to-the-minute, accurate information on which to base their trades,” said Timothy Tam, co-founder and CEO of CoinFi and former Goldman Sachs equities trader. “The partnership with eToro will help more than 10 million users make more informed decisions by keeping up to date on the latest news and market indicators.”

The addition of CoinFi’s research and data to the eToro platform facilitates a shared vision for both companies of opening up global crypto markets to everyone by offering transparent tools, news, and information. CoinFi is a currently the largest online crypto assets database, with information on more than 6,000 crypto assets and initial coin offerings (ICOs). The company also offers advanced token metrics for the entire Ethereum blockchain.

“Our deal with CoinFi further enhances our values, specifically innovation, openness, and quality,” said Yoni Assia, Co-Founder and CEO of eToro. “Traders and investors using the eToro platform want the most authentic, high quality information and data available for the crypto markets. Easy access to reliable information is paramount.”

Founded in 2007, eToro enables people to invest in the assets they want, from stocks and commodities to crypto assets. It is a global community of more than ten million registered users who share their investment strategies; and anyone can follow the approaches of those who have been the most successful.. eToro has raised $162 million in funding to date.

About eToro

eToro was founded in 2007 with the vision of opening up the global markets so that everyone can invest in a simple and transparent way. The eToro platform enables people to invest in the assets they want, from stocks and commodities to cryptoassets. eToro is a global community of more than ten million registered users who share their investment strategies; and anyone can follow the approaches of those who have been the most successful. Due to the simplicity of the platform users can easily buy, hold and sell assets, monitor their portfolio in real time, and transact whenever they want.

As most of you already know, November marked a very exciting and busy month for us as we made significant progress on all fronts.

Our staked users have started receiving

As most of you already know, November marked a very exciting and busy month for us as we made significant progress on all fronts.

Our staked users have started receiving

In fact, COFI stakers are now collectively the 11th largest holder of COFI tokens on the blockchain!

As of this writing, beta users have staked 2,960,622.9548 COFI tokens for early access to CoinFi Trading Signals, which is 1.685% of the circulating supply of COFI.

The tagline for our signals is “Professional trading signals backed by data science”, so this month we thought we’d share some of the data science underlying these trading signals.

In fact, COFI stakers are now collectively the 11th largest holder of COFI tokens on the blockchain!

As of this writing, beta users have staked 2,960,622.9548 COFI tokens for early access to CoinFi Trading Signals, which is 1.685% of the circulating supply of COFI.

The tagline for our signals is “Professional trading signals backed by data science”, so this month we thought we’d share some of the data science underlying these trading signals.